By Zia Saylor

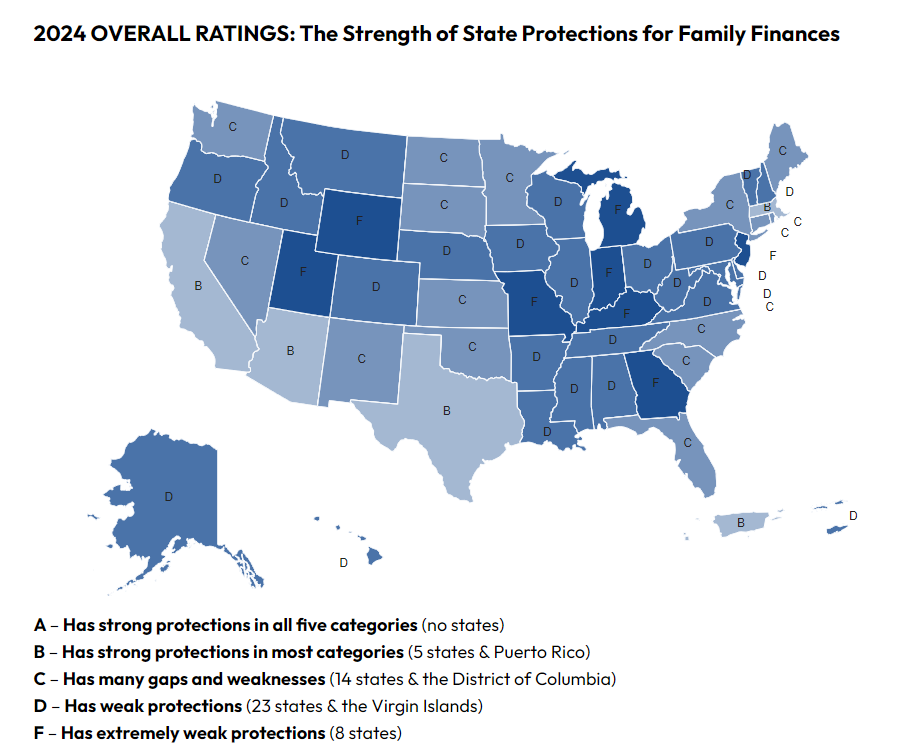

Last year, the Institute wrote about Indiana receiving a poor grade - a “D” - in the National Consumer Law Center annual gradings of state debt protection laws. This year, Indiana’s grade has dropped even lower - from a “D” to an “F” - as a result of inflation and the state's failure to act to protect Hoosiers. States were graded based on their score on the following five criteria:

-

Whether individuals’ wages could be garnished to their point that they are below a living wage;

-

Whether individuals can retain a car of near-average value;

-

Whether a household can retain a median-value home;

-

Whether individuals can retain funds necessary for daily life;

-

Whether individuals can have basic everyday household goods seized by creditors and sold.

In short, the grade measures the extent to which a state's residents can keep their head above water when they fall behind on medical bills or loans. Receiving an “A” would mean that a given state ensures protections for individuals and households, allowing for living wages, a near-average-value car, a median-value home, essential funds, and household goods, even in the presence of debt. Unfortunately, however, no state received an “A.” Five states received a “B,” 14 states received a “C,” 23 states received a “D,” and only seven other states joined Indiana in receiving the lowest grade: an “F.”

Graphic Source: National Consumer Law Center

In previous years, Indiana has not been graded so low, earning a “D” in the 2023 grading and a “D-” in the 2019 grading. The reason for this year’s drop is due to the fact that Indiana only updates values of homes, cars, and goods every six years, but with inflation and increasing costs of living, the relative value of the amounts in all categories has declined. One example of this is that for both years, $450 was the amount in a bank account Hoosiers could have protected for everyday essentials, yet this amount can not stretch as far in 2024 as it did in 2023, leading to a categorical grade decrease from “D” to “F.” Similar declines were present in the other categories, leading to an aggregate shift downwards in Indiana’s grade. Importantly, the change was not caused by policy action but rather by policy inaction, something that remains a policy choice nevertheless.

Such policy inaction and lack of protections set Indiana apart from Midwest neighbors, including Ohio and Wisconsin, both of which earned a “D” in this year’s grading system and a “C” the year before. While Indiana only allows individuals with debt to keep a home worth $22,750, individuals in Ohio and Wisconsin with debt can maintain homes worth $161,375 and $75,000 respectively, with Ohio adjusting this amount every three years to account for inflation.

Indiana’s relatively punitive laws force Hoosiers to make tough choices between food, electricity, and paying off debt, even as an estimated 23 percent of Hoosiers have debt in collections. Debt can come from a variety of sources–including from student loans of Hoosiers seeking to engage in the state economy or from unexpected expenses such as those from storms or hour cuts at work, yet this legislative inaction perpetuates harm against Hoosiers by leaving them with only $217.50 per week to live off of.

Medical debt, too, represents a large portion of the debt incurred by Hoosier households, with a total of 6 percent of all Hoosiers having medical debt on their credit reports as a result of trying to access necessary healthcare for themselves or loved ones. While these statistics may seem remote, they are the reality for many: consider a mother with a baby in the NICU who could fall into debt as a result of high bill costs and lose nearly the entire value of their home. Just this happened to Deborah Fisher, a longtime Indianapolis resident, who said the experience of medical debt and losing her home and garnished wages “...felt like I was trying to make my way back up the ladder, only to fall back down to the bottom. It was like being punished and re-punished all over again — all because I had a baby that needed medical care.” (More testimonies speaking to the harm of medical debt in particular can be found in on the Institute’s blog.)

Cumulatively, it is critical in the coming session that with the cost-of-living crisis, the state legislature take action to address the needs of Hoosiers, including by ensuring that households can maintain financial well-being as they work to pay off a debt.

Take Action: In cases of legislative inaction such as with debt protection legislation, it is imperative to share with your state legislators what such change would mean to you and how it would impact your life.

-

To find the contact information for your legislator and reach out to them on your own, you can do so through the General Assembly web page.

-

Share your story of medical debt with legislators through our Action Network page, and let your legislators know what policy changes you would like to see in the coming session.

-

Sign up for the Institute’s mailing list to stay up-to-date on the latest research and opportunities to get involved in changemaking.

This blog post is made possible thanks in part to the support of the Indianapolis Foundation, a CICF Affiliate. We thank them for their support but acknowledge that the findings and conclusions presented in this are those of the Indiana Community Action Poverty Institute alone, and do not necessarily reflect the opinions of the Foundation.