Financial Drains

Income is an important part of the financial stability equation, but it is also essential to watch out for financial drains. We ensure that policies encourage responsible lending and borrowing and that Hoosiers who are paying on debts are still able to meet their basic needs. Our policy work in this area includes:

- Payday Lending

- Student Loans

- Debt Collections

- Medical Debt

Featured Publications

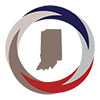

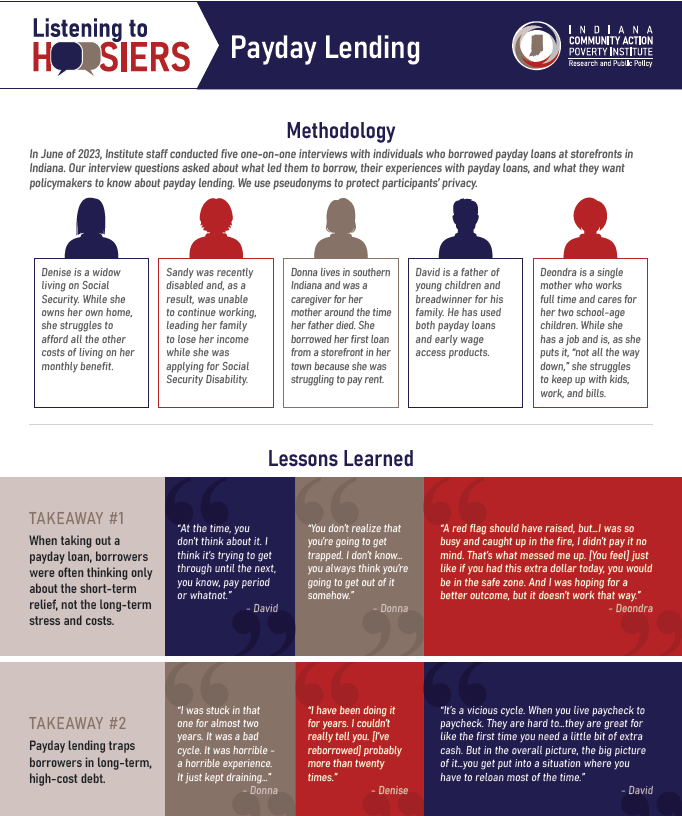

Listening to Hoosiers: Payday Lending

Payday loans are short-term, extremely high-cost loans that trap many borrowers in costly debt. Our interviews with Hoosiers add to the existing understanding of who borrows payday loans and why, what they know (and don't know) when they borrow, how the cycle of borrowing and reborrowing affects them, and what supports they would like to see instead. | FACT SHEET

|

Financial Drain: Payday Lenders Extract Millions from Hoosier Communities Financial Drain: Payday Lenders Extract Millions from Hoosier Communities

This update on our 2019 report shows that payday lenders drain over $29 million in finance charges from Hoosier borrowers annually on loans that average $386. Effective January 2023, the maximum payday loan increased from $605 to $715, and lenders can charge rates as high as 391% Annual Percentage Rate (APR). As the report shows, Indiana saw a precipitous drop in loan volume during 2020, likely due to robust federal support in response to the COVID-19 pandemic. Since the expiration of important federal supports such as the expanded Child Tax Credit, additional unemployment insurance, and rental assistance, payday loan volumes are trending toward their pre-pandemic levels. | REPORT

|

Medical Debt in Indiana

Hoosiers should be able to go to the doctor or purchase medicine without worrying about crushing medical bills. Unfortunately, the burden of medical debt is particularly acute in Indiana. This report discusses the health and social impacts of medical debt, explains how individuals become indebted, provides data about financially vulnerable Hoosiers and statewide trends, summarizes recent government and private action, and recommends policy solutions to address rising medical debt. | REPORT

|

Other Publications

Take Action!

|