By Olivia Smith

The Indiana General Assembly will be kicking off the state’s 2025 legislative session on January 8th, and during this budget building year, our legislators are poised to make policy decisions that will impact Hoosiers across the state. While there are no bills listed yet on the General Assembly’s website, we do have some ideas of their tax-related legislative priorities based on the final report of a multi-year task force that concluded last month. Let’s review the legislative mandate given to that tax task force and examine how their recommendations for policy changes could affect taxpayers.

--------

The State and Local Tax Review Task Force (SALT Task Force) was established in 2023 by Senate Bill 3 and was directed to meet at least four times in both calendar year 2023 and calendar year 2024, with a requirement to produce a final report with policy recommendations before December 2024. Initially, the task force was charged with studying the following topics:

-

The state's near term and long term financial outlook and overall fiscal position.

-

The state's appropriation backed debt obligations.

-

The funded status of pension funds managed by the state, including methods to reduce the unfunded actuarial accrued liability of the pre-1996 account within the Indiana state teachers' retirement fund.

-

The individual income tax, including methods to reduce or eliminate the individual income tax.

-

The corporate income tax.

-

The state gross retail and use tax, including a review of the state gross retail tax base.

-

The property tax, including methods to reduce or eliminate the tax on homestead properties and reduce or eliminate the tax on business personal property.

-

Local option taxes, including the local income tax, food and beverage taxes, and innkeeper's taxes.

During the 2024 legislative session, House Bill 1120 added several more items to the list of topics for the members of the SALT Task Force to consider. These new additions were more specific subsets of the initial eight topics and focused primarily on local tax issues related to property tax assessments and local unit revenue-raising mechanisms.

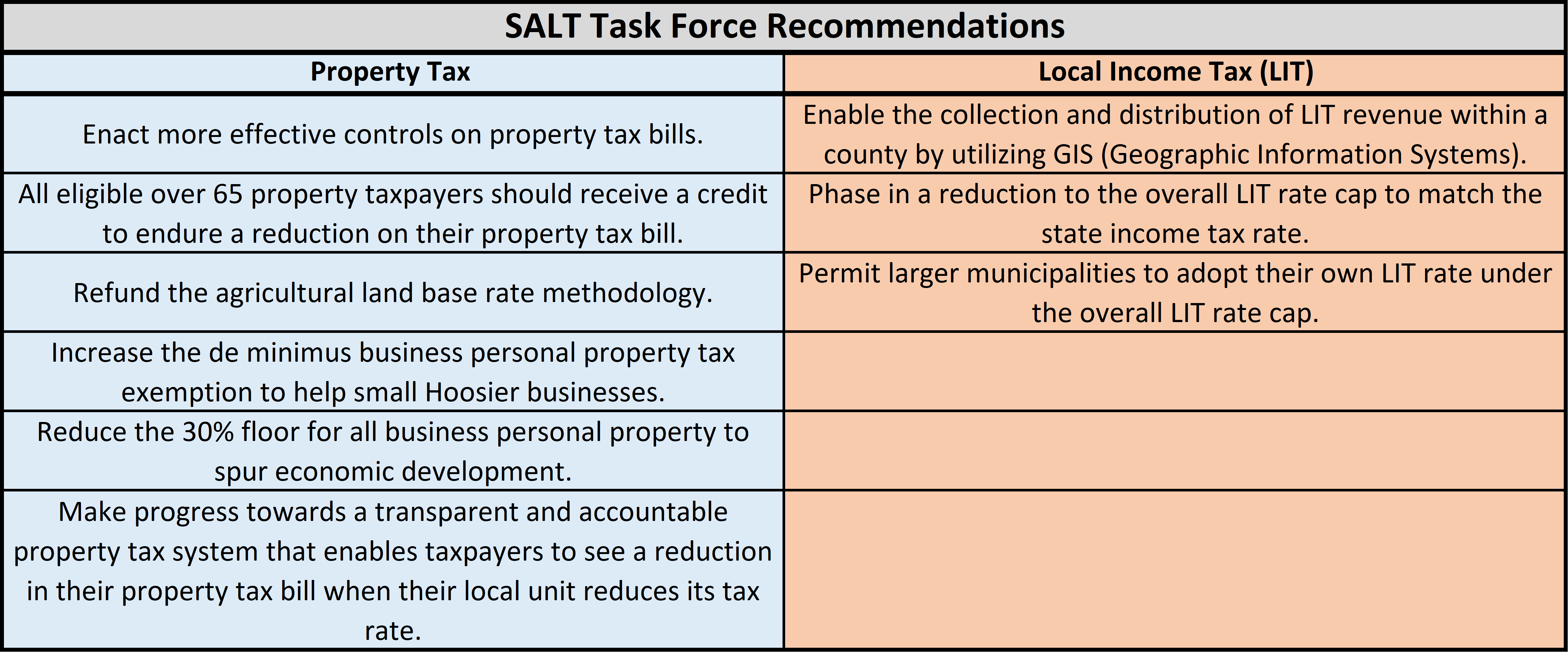

The SALT Task Force did meet eight times over the past two years, hearing from various tax experts and researchers, state agency officials, and advocates, among others. [Archived video and meeting minutes are available for the public on the General Assembly’s website for both 2023 and 2024.] In their last meeting on November 20th of this year, the SALT Task Force released their final report with recommendations. Despite the lengthy list of tax topics investigated, the only two tax types where the final report makes recommendations are for property taxes and local income taxes, as shown in the table below.

While we see three property tax recommendations focused on reducing taxes for business property and farmland, the only specific policy put forth to help curb homeowner property tax bills is a tax credit targeted to help senior homeowners. Administrative change recommendations are included for both tax types, but neither would actually result in tax relief for Hoosiers. Another important thing to note about these recommendations is that property taxes and local income taxes are both revenue sources that do not go to the state to be spent; instead the revenue from these tax types go directly to counties so they can fund the operation of local units such as public schools, libraries, and emergency services.

Ultimately, the SALT Task Force did not address any ways to reduce tax burdens for families through changes to Indiana’s state-collected tax types: sales tax, income tax, or corporate tax. This is especially disappointing given how many Hoosiers are feeling the pinch of inflation, since we know that sales tax and individual income tax make up almost 64% of the tax revenue collected by the state. The just-released Ball State Hoosier Survey also shows that folks in Indiana recognize the unequal burden created by our regressive sales tax, with more respondents rating retail sales tax as being very or somewhat unfair than state income tax or property taxes.

As this final report makes abundantly clear, this complicated thing we call “tax policy” is really just the set of choices that reflect our state’s priorities. Our legislators have many more opportunities to support families through the tax code than are presented in this final report: let’s challenge them to be innovative and make Indiana’s tax code prioritize regular families by funding the things that make Indiana a great place to live, including our schools, parks, and communities.

This blog post was funded by the Annie E. Casey Foundation. We thank them for their support but acknowledge that the findings and conclusions presented in this are those of the author alone, and do not necessarily reflect the opinions of the Foundation.