by Olivia Smith

If you’ve been following along in our blog series, you know we’ve covered how Indiana collects tax revenue, how our state legislature develops and allocates spending over a two-year budget, and most recently, how different tax policy mechanisms like credits, deductions, and exemptions can be used to provide tax relief.

This week, we’re bringing together everything we’ve learned so far to explore the concept of tax burdens and examine ways that policy choices can provide meaningful tax relief to Hoosiers.

Types of Taxes: Structure Matters

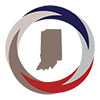

A tax burden is the amount of a given tax shouldered by a particular group. Usually, we look at tax burden by income level to see how a particular tax or tax system impacts people differently across varying levels of means. When we are talking about tax burdens, what we are really asking is “Who pays?” The following definitions are the foundational terms we use to describe how those tax burdens are structured.

- A regressive tax is one where the average tax burden decreases with income. For example, if two individuals who make $30,000 and $60,000 each spend $1,000 on clothing for their family in a year with a 7% sales tax rate, the lower-earner will be paying more taxes as a share of their income ($70/$30,000 = 0.2%) than the higher-earner ($70/$60,000 = 0.1%).

- A progressive tax is one where the average tax burden increases with income. Our federal individual income tax is a progressive tax that has marginal tax rates that range from 10 percent to 37 percent. This design leads to higher-income individuals paying a larger share of federal income taxes than lower-income individuals.

- A proportional tax, or flat tax, is one where the average tax burden is even across income groups. Indiana’s individual income tax is a flat tax of 3.05%, which means everyone pays that same proportion of their income in tax, regardless of how much income they earned.

Source: Institute on Taxation and Economic Policy (ITEP)

The Institute on Taxation and Economic Policy’s Tax Inequality Index measures the effects of each state’s tax system on income inequality. According to this measure, Indiana has the 14th most regressive state and local tax system in the country. This means that income disparities are actually larger in Indiana after state and local taxes are collected than before.

Let’s pause and consider what that means: Indiana’s current tax system worsens Hoosier income inequality.

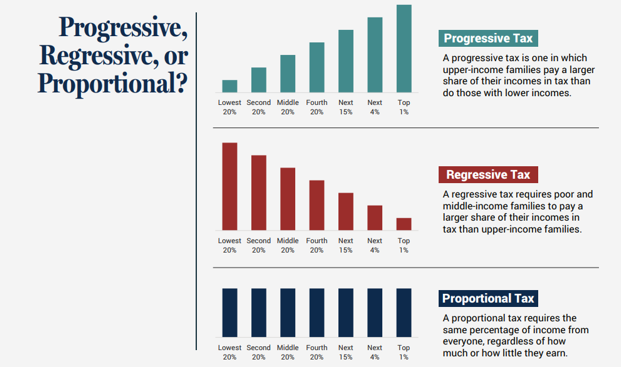

This becomes starkly clear when we look at how much people pay in taxes as a share of their family income. The table below compares the amount of all tax paid (income tax, property tax, sales and use tax, and other taxes) to a family’s income to see what percent of their income goes to paying taxes.

Source: Institute on Taxation and Economic Policy, using 2023 income data and 2024 Indiana tax law.

The lowest 20% of earners pay the highest share of their income in taxes at 13.3%, but as income increases, that burden reduces to just 6.2% for the wealthiest 1%. Hoosiers making less than $22,600 annually are paying more than double the amount of taxes as a share of their income than Hoosiers making over $574,200. By comparing this graph to our definitions of tax types, it is clear that Indiana maintains a very regressive tax system- we can see plainly that the average tax burden decreases with income for someone living in Indiana.

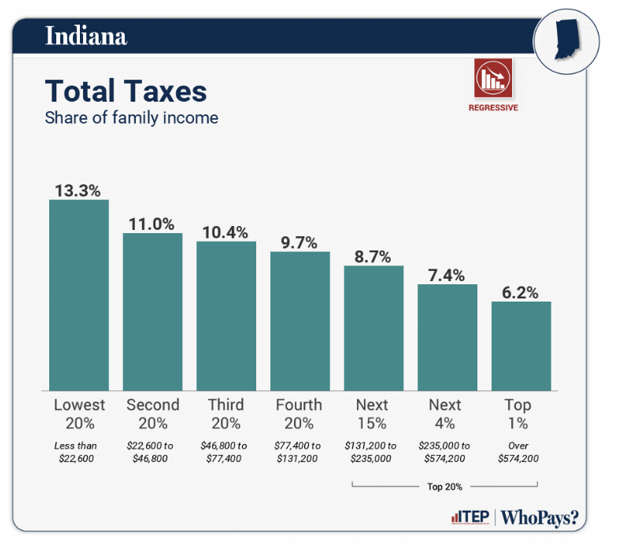

It might be surprising to learn that Hoosiers making the least money are saddled with the highest tax burden out of any income group. Unfortunately, Indiana is not alone with this problem. Even states that have less regressive tax systems than us are still placing a disproportionate share of their tax burden on low-income families. The chart below shows which income group pays the lowest effective tax rate in their respective state.

Source: Institute on Taxation and Economic Policy (ITEP)

Shockingly, 41 states have tax policies that lead to the top 1% of earners paying the least amount of tax as a share of their income out of any income group! Many of the most regressive tax systems have another trait in common: they are frequently hailed as “low tax” states. But this raises the question: “low tax” for whom? ITEP’s research found that very few states achieve low tax rates across the board for all income groups, and those that do usually rely heavily on energy or tourism sectors that cannot realistically be replicated elsewhere.

Tax Policy is a Choice

At the end of the day, these inequitable outcomes are the result of choices made by our policymakers at the state and federal level. However, that means that we can demand our lawmakers rewrite the rules to ensure that tax relief goes to the folks who need it the most. There are several policy choices that Indiana could make its tax system less regressive and help relieve the high tax burdens on lower- and middle-income Hoosiers:

- Create a property tax “circuit breaker” credit for low-income taxpayers

- Implement a Child Tax Credit

- Increase Indiana’s comparatively low individual income tax exemptions

- Increase the state’s Earned Income Tax Credit

- Use combined reporting as part of its corporate income tax

When we join together to make sure that the wealthiest pay what they owe our state through taxes, we will make Indiana a place where we all have what we need to overcome our challenges and keep our families safe and well.

TL;DR: This week, we’re bringing together everything we’ve learned so far in the blog to explore the concept of tax burdens and examine ways that policy choices can provide meaningful tax relief to Hoosiers. Tax burdens are a way of answering the question “Who pays?” when considering the impact of a tax. A regressive tax is one where the average tax burden decreases with income, a progressive tax is one where the average tax burden increases with income, and a proportional tax, or flat tax, is one where the average tax burden is even across income groups. ITEP’s Tax Inequality Index shows that income disparities are actually larger in Indiana after state and local taxes are collected than before. In fact, Hoosiers making less than $22,600 annually are paying more than double the amount of taxes as a share of their income than Hoosiers making over $574,200. Indiana isn’t alone — 41 states have tax policies that lead to the top 1% of earners paying the least amount of tax as a share of their income out of any income group. These inequitable outcomes are the result of choices made by our policymakers at the state and federal level, but that means we can demand our lawmakers rewrite the rules to ensure that tax relief goes to the folks who need it the most.

This blog post was funded by the Annie E. Casey Foundation. We thank them for their support but acknowledge that the findings and conclusions presented in this are those of the author alone, and do not necessarily reflect the opinions of the Foundation.